June 10, 2022

Bring Chicago Home, a grassroots coalition dedicated to securing an earmarked revenue stream to combat homelessness, has launched a campaign to put a referendum on the City of Chicago ballot asking voters to approve an increase in the Chicago real estate transfer tax (RETT) for high-end properties selling for over $1 million. Properties valued at less than $1 million would continue to be taxed at current rates. Changes to the current tax must be approved by voters in a referendum or through a change in state law. The tax has been described as a “mansion” tax, but it would apply to commercial and industrial as well as residential properties.

Under Bring Chicago Home’s proposal, the transfer tax for purchasers of high-end properties valued at over $1 million would rise substantially from $3.75 per $500 of a property’s total sale price to $13.25 per $500 in value. The cost to a buyer of a $1 million property would rise from to $7,500 to $26,500. Revenues from the increase in the transfer tax would be earmarked for homeless programs. Bring Chicago Home estimates that the transfer tax increase could generate as much as $163 million annually to provide permanent affordable housing and related services for the homeless.

Increasing Chicago’s real estate transfer tax requires the City Council to approve a resolution placing a referendum on the municipal ballot. To date, ten alderpeople have indicated support for a referendum, sponsoring a resolution in July 2021 asking the City to put this issue on the November 2022 ballot.

In recent years, several proposals have been made calling for implementing a graduated real estate transfer tax that would impose a higher rate on more expensive properties to pay for affordable housing, the removal of lead pipes in homes, police and fire pensions or homeless programs. In 2019 Chicago Mayor Lori Lightfoot attempted to secure legislative approval of a graduated transfer tax, but that effort was not successful.

Supporters of a “mansion” tax targeting funding for homeless programs argue that the City’s current efforts to combat homelessness are inadequate. They note that the City budgeted $26 million in FY2022 for homeless programs, compared to $637 million in Los Angeles and $1.4 billion in New York City. They also argue that the proposed RETT increase would affect only about 5% of all real estate transactions in Chicago, targeting only the most highly valued properties.

Opponents of the transfer tax increase note that the impact of a transfer tax increase would be borne heavily by commercial properties. Downtown office occupancy rates have not rebounded to pre-COVID 19 levels and commercial property taxes are among the highest in the nation. Finally, regular fluctuations in tax revenues over time due to market shifts may make the transfer tax an unreliable source of revenue for homeless programs over time.

Real Estate Transfer Taxes in Chicago

A real estate transfer tax is imposed upon the privilege of transferring title to, or beneficial interest in, real property. State and local governments in 36 states impose this tax.[1] More information about real estate transfer taxes can be found here.

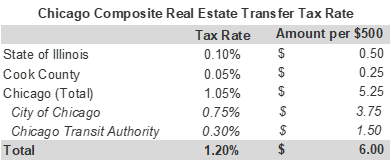

In Chicago, the RETT is currently imposed by the State of Illinois, Cook County and the City of Chicago. The City imposes the tax as both a municipal and home rule real estate transfer tax.[2] The composite rate of the RETT is $6.00 per $500 in property value transferred, or a rate of 1.2%.

The State of Illinois imposes a real estate transfer tax of $0.50 per $500 in value, or 0.10%. The County imposes a real estate transfer tax of $0.25 per $500 in value (0.05%). State and Cook County real estate transfer taxes are paid by the seller.

State transfer tax revenue is deposited into the Illinois Affordable Housing Trust Fund, the Open Space Lands Acquisition and Development Fund and the Natural Area Acquisition Fund. Cook County tax revenue is deposited into the County’s General Fund.

The City of Chicago imposes the tax at a rate of $3.75 per $500 in value (0.75%) plus a supplemental amount of $1.50 per $500 in value (0.3%) for a total City rate of $5.25 per $500 in value or 1.05%. The buyer is responsible for paying the $3.75 portion and the seller is responsible for paying the $1.50 portion of the City tax. The $3.75 per $500 in value portion of the tax is deposited in the City’s Corporate Fund. The $1.50 per $500 in value portion is transferred to the Chicago Transit Authority. The tax was expected to generate approximately $156.6 million in revenue in FY2022.[3] There are various exemptions to the real estate transfer tax. For example, the City of Chicago exempts sales under $500, bankruptcies and Enterprise Zone transfers from the tax.

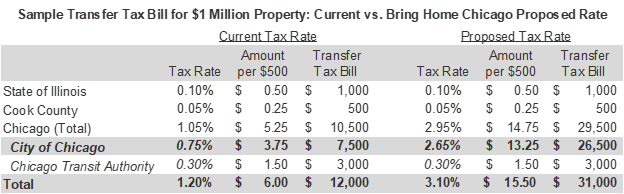

Impact of the Bring Chicago Home Proposal on a $1 Million Property

The table below compares a real estate tax bill for a $1 million property under the current real estate transfer tax rate with the increased rate proposed by Bring Chicago Home. The only tax component changing would be the City of Chicago RETT on properties valued over $1 million.

The composite tax rate would increase from 1.20% to 3.10% for those properties. The total tax amount per $500 of value would rise from $6.00 to $15.50. Finally, the transfer tax bill on a $1 million property would increase from $12,000 to $31,000. Bring Chicago Home estimates that increasing the tax would generate approximately $163 million per year.

[1] Illinois Commission on Governmental Forecasting and Accountability. Illinois Tax Handbook for Legislators. July 2021, pp. 108-109.

[2] See 35 ILCS 200/31-10); 55 ILCS 5/5-1031; 65 ILCS 5/8-3-19(i); Code of Ordinances of Cook County, Illinois, Chapter 74, Article III; and City of Chicago Municipal Code, Chapter 3-33.

[3] City of Chicago 2022 Budget Overview, p. 42 at https://www.chicago.gov/content/dam/city/depts/obm/supp_info/2022Budget/2022OverviewFINAL.pdf.